MICAELA STANALAND | February 6, 2023 | Warwick, NY

Warwick January 2023

National news might be saying one thing about the real estate market, but Warwick's local market is off to quite the start in 2023. This January, the 10990 zip code saw record median sale prices not just for the month, but the highest in over a decade.

Let's take a look at the Warwick market and what it could indicate for the remainder of the year.

All data courtesy of OneKey MLS

Micaela Stanaland

Warwick Real Estate: The Overview

New Listings January 2023

This past January, there were a total of 15 single-family homes that came on the market. In real estate, we call these "New Listings".

New listings are important to watch because they give both sellers and buyers an indication of inventory, and whether inventory is increasing or decreasing. When there are less new listings coming on the market, inventory is likely to decrease.

Why does it matter? Decreasing inventory means there are less homes for buyers to chose from. A continuously decreasing inventory will more often result in a "seller's market". A continuously increasing inventory will likely result in a "buyer's market". As a seller, it's important to understand New Listing trends to know when you'll be facing the most competition in your market. As a buyer, it's important to understand New Listing trends to know when you'll likely have more inventory to chose from.

January is a historically low-inventory month in Warwick and the Hudson Valley overall. We have a seasonal market, which more often than not hits new inventory highs in the spring months of May and June. and new inventory lows in the winter months of November and December.

In January 2023, there were only 15 new single-family listings to come on the market in Warwick's 10990 zip code. This is 25% lower than the month's ten-year average of 20 new single-family listings, an indication that we'll still see lower than average inventory this year. However, this January's new listing inventory was slightly higher than last year's (January 2022), when there were only 13 new single-family listings to come to the market.

What does this mean?

As a seller, there's less competition right now if you're thinking about selling your home. This is generally the case anyways for the winter market in Orange County. This could mean you're more likely to get a higher sales price for your home than when inventory is heavy, BUT - don't make the mistake of overpricing your home. While the median sale prices are still on the rise,

As a buyer, there's less new inventory for you to chose from. Inventory likely won't pick up for at least another few months when we head into our Spring market around the end of March. Keep in mind, this is also when more buyers start looking for homes. Make sure you're on an auto-search with the criteria for your ideal home and area and keep an eye out for homes that come on in the winter that those Spring buyers will miss! (And if you're not on one, click the link to sign up!)

Fun facts & figures from 2013 on: January's new listing inventory peaked in 2013 when there were 27 homes that came on the market. June 2020 had the highest number of new listings in the last ten years, when 95 single-family homes came on the market.

Our Inventory Prediction for 2023:

We're still predicting that new listings will begin to rise as the year goes on. If you're wondering by how much...

From 2013 to 2022, we saw a yearly average of 353 new listings come on in Warwick (10990 zip code).

In my opinion, I think we'll see lower than average inventory continue in 2023 but higher than 2022's total of 280 new listings. Where will the new listings come from? Warwick has a sprinkle of new construction projects underway which will be great for inventory and those "move-up" buyers. There's also the continued increase of New Yorkers selling their homes and moving to warmer weather, in addition to those that purchased a home in 2020/2021 and coming to the realization that the house they may have rushed to purchase doesn't really work for them.

For those that didn't buy in that time frame and are sitting on a little more equity, we're seeing a decent amount of sellers feeling like they "missed the boat" on the hottest seller's market our area has ever seen (check out the absorption rates we discuss later). The market it still up for sellers, but I wouldn't expect the multiple offer in 24-hours situation, especially for the higher end market.

More listings will obviously give buyers more options, although a lot of buyers are pumping the breaks until interest rates come down, which they have simce October 2022. If you are a buyer worried about interest rates, keep in mind that if/when rates come down, you can always refinance. Marry the home, date the rate.

BUYERS: Don't forget to check out our affiliate's BUY-DOWN Program which can help you save on interest rates for the first 1-3 years of your mortgage. For more information, reach out to us at micaela.stanaland@randrealty.com or call/text (845) 596-9414

Median Sale Price January 2023

So, we just discussed new listings and how the lower the amount of new listings to hit the market, the less inventory buyers have to chose from. Low inventory in any market will cause prices to remain elevated until inventory can meet demand. Although mortgage rates may be up from previous years, people still need a place to live, and they are definitely looking at Warwick.

Warwick's median sale price in January 2023 hit a TEN YEAR HIGH, reaching an astounding $702,500. We repeat, astounding.

Warwick's median sale prices (and number of sales) in January by year:

- January 2013: $202,500 (6 sales)

- 2014: $394,000 (13)

- 2015: $293,100 (10)

- 2016: $367,000 (18)

- 2017: $350,000 (19)

- 2018: $375,000 (19)

- 2019: $384,500 (20)

- 2020: $385,000 (22)

- 2021: $447,450 (30)

- 2022: $549,500 (24)

- 2023: $702,500 (14)

So, what gives?

The 14 sales that Warwick saw in January ranged from $360,000 to $950,000, had a median of 2,700 square feet of living space on 1.4 acres of land, with a median construction year of 1998. Of these 14 sales, 5 (or 36%) were new construction which do sell at a premium. But even if we were to take those new construction sales out of the equation, the median sale price for the remaining 9 sales was $672,000 - which would still be the highest median sale price 10990 has ever seen in a single month.

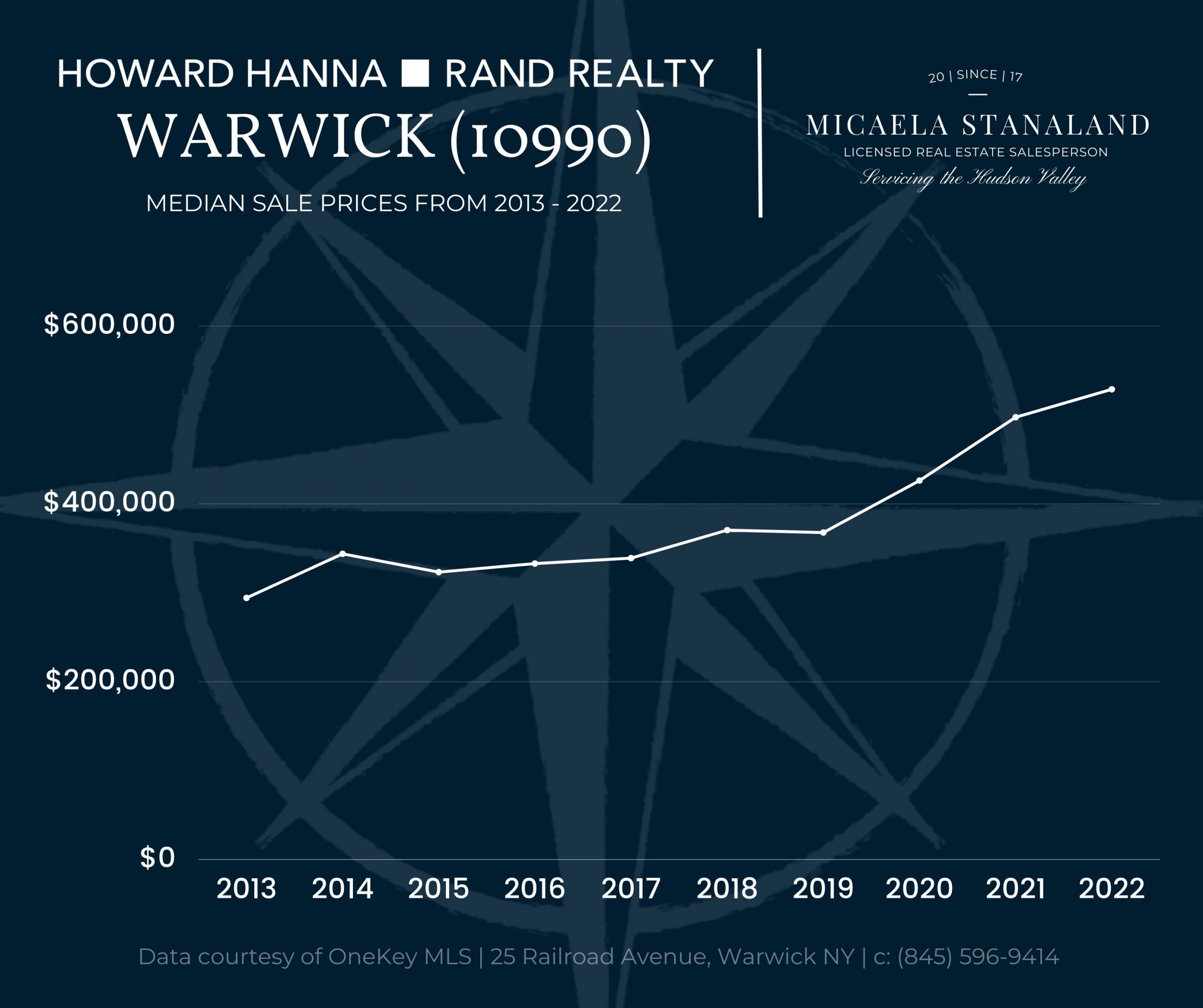

Median Sales Prices by Year in Warwick, NY (1099)

Since 2013, the median sale price in Warwick has generally been on the rise. Prices really started to jump from 2019 to 2020, when median sale prices increased by 16% in Warwick. From 2020 to 2021, the median sale price increased again at a rate of 17% slightly higher than the year before.

In 2022, we were still seeing an upward trend in prices, but at a much slower rate compared to the two years prior. In 2022, prices rose at a rate of 6% from the year before.

What does this mean?

From mid-2020 through the first half of 2022, we had the perfect storm for real estate. Low interest rates combined with low inventory and high buyer demand was every seller's dream. Majority of properties were calling for "Highest and Best" offers within days of hitting the market, and more often than not selling for over asking price.

But even before 2020, Warwick's real estate market was on the rise. Since 2017, homeowners in 10990 were getting an average of 96% or more of their original asking price.

When we look at the beginning of the pandemic market in 2020, homeowners were getting a median of 97% of their original asking price, followed by 100% in both 2021 and 2022. In January we saw that trend do nothing but continue, with the median sale price closing at 100.01% of the original asking price.

Of the 14 sales in January 2023, 10 went for over or above their original asking price.

Curious to see how many people are looking for a property like yours? Check out the buyer heat-map for your home here.

Price Prediction for 2023:

If I had to guess an increase or decrease in the median sale price for Warwick, I'd say increase.

In the past 10-years, the median sale prices within a single year have ranged on average $161,000 between the month with the highest median sale price and the month with the lowest.

If we take January 2023's median sale price of $702,500 and say that's the highest median sale price any month will see this year (even though January has never had the highest median sale price in the past ten years), that still puts us at $541,500 for the month with the lowest median sale price. Even at that number, that's still a a 2.8% increase from 2022. That type of increase is healthy for real estate markets, and slows down that ominous "bubble".

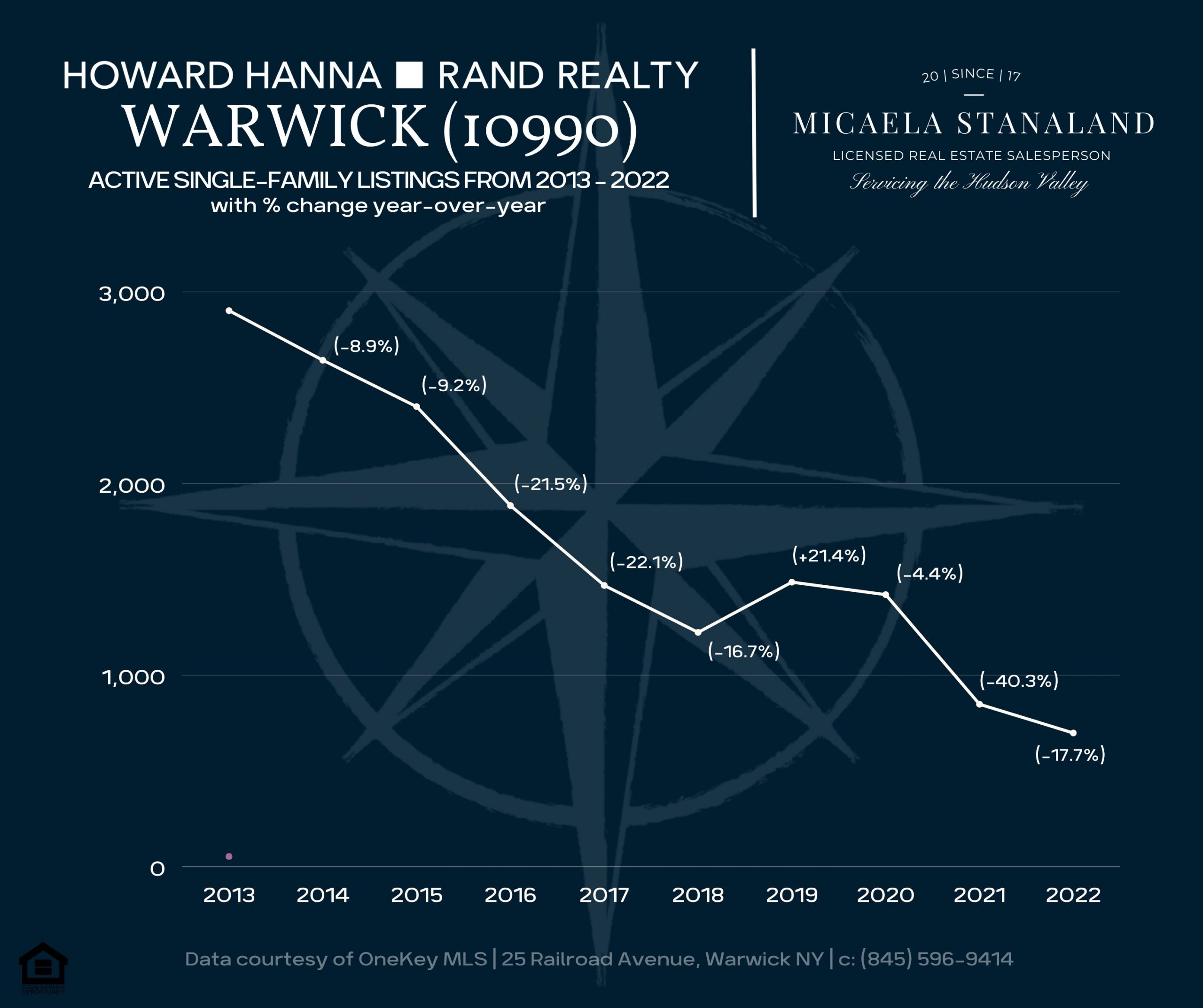

Active Listings in 2022

Active Listings show us the number of homes that are currently on the market for sale. They can be new listings, listings from the month prior, or even listings still on the market from last year.

The lower the number of Active Listings, the less inventory buyers have to chose from.

Low inventory makes for a competitive market for buyers, and is generally found in a "seller's market". High inventory makes for a competitive market for sellers, and is generally found in a "buyer's market".

Active inventory in Warwick's 10990 market has been on the decline for the past 10-years, with the exception of 2019. On average, active inventory has decreased at a rate of 13.26% since 2013. In January 2023, we saw the fewest number of active listings in a given month, with just 35 single-family homes for sale in OneKey MLS. Prior to that, the lowest amount of homes available was in December 2022 (the month prior), with only 37 homes on the market.

Active Listings in Warwick (10990) from 2013 to 2022:

What does this mean?

In the real estate industry, we look at number of active listings as an indicator for two things:

(1) The "competition" our sellers have in a given market

(2) The absorption rate of a given market

An "absorption rate" is a percentage calculated by looking at how fast homes are selling in a specific market within a certain timeframe. The general rule of thumb is anything over 20% is a seller's market and anything below 15% is a buyer's market.

From 2013 to 2016, Warwick's absorption rate ranged from 5.8% to 13.7% which we'd classify as a buyer's market.

If you bought your home during this time, you probably paid under what the seller was asking for. In fact, single-family homes purchased from 2013 to 2016 in Warwick closed for an average of 93.8% of the original asking price. If you're thinking about moving, this current winter market could be the perfect time to list your home for sale (as of today, you'd only be competing with 34 other sellers!).

From 2017 to 2020, we saw a neutral market for buyers and sellers with the absorption rate ranging from 16.3% to 19.4% in Warwick. This is further reflected in the average close to original list price during those years, where homes were closing at 96.7% of their original asking price.

During 2021 and 2022, we saw one of the strongest seller's markets ever, with the absorption rate at 36.7% and 34.8% respectively. Homes on average closed at 99.6% of their original asking price. This is better reflected in 2021 and 2022 when on average homes closed for 100.3% of their original asking price. This means majority of buyers were paying over what sellers were asking for their homes (likely due to multiple offers and bidding wars).

Our Predictions for 2023:

With sales slowing down and less buyers in the market, tied in with our prediction of inventory increasing this year, we're predicting active listings are going to rise in Warwick.

Why? Sellers are going to need time to adjust to a slower market (read: lower sales prices) which in turn will leave buyers reluctant to make offers on homes that are over-priced. Tie this in with a slightly smaller buyer pool because of higher interest rates (read: less people looking at and making offers on homes) and that's going to leave even more homes on the market.

2023 will be all about pricing correctly, and strongly. Make sure you hire an agent that knows your local inventory, and be realistic about the upgrades/improvements your property needs that buyers aren't readily overlooking anymore.

As an agent that represents both buyers and sellers, I can say majority of buyers are not waiving inspections or appraisals anymore. Unless you have a home in pristine condition, you can expect buyers to ask for repairs and/or credits for those larger ticket items.

The Recap:

The wild west real estate market we saw throughout 2020 and 2022 is slowly calming down. We don't see it being the "Real Estate Armageddon" that some media companies are forecasting, but rather a slow-down that will lead to a healthier market over time.

Sellers: Don't anticipate a multiple offer situation in 24-hours like we were seeing these last couple years. Have patience with the market and with the buyers (especially during the slower winter months). If you're getting ready to list your home this year, take the time now to make those repairs that buyers are more likely to call out during the inspection process. Not sure what needs to be done? Get in touch with us for a no-obligation analysis of your home. Pricing correctly and marketing strongly is going to be your key to closing.

Buyers: There aren't as many of you out there these days, but that doesn't mean there aren't any of you. A cooling market will work in your favor. For the best "deals", look at homes that have been on the market a little longer and might need a little more TLC (if you're up for it). Buyers are for the most part looking for homes that are move-in-ready and need little to no upgrading, so if you don't mind putting work into a home, the properties that need it are likely going to be the ones with little to no offers on the table.

Inventory is still low. At the time we wrote this article there were only 636 single-family homes available in the MLS in all of Orange County. There have been 224 single-family home sales in the past thirty days. This puts us at an absorption rate of 35.2% (remember that anything under 15% is a buyer's market, anything above 20% is a seller's market).

I personally believe the winter is a great time to look for a home because there aren't as many buyers out there. Start your search here or get in touch with us to see what steps you should be taking to become a stronger buyer.

We work with buyers and sellers throughout Rockland, Orange, Bergen and Westchester Counties. With our widespread connection to other brokers, we can help anyone relocate out of those particular areas - whether it's Florida, California, or even a different country!

If you have questions about your move or the market in general, we're always happy to talk.

Don't forget to share this page with friends and family in Warwick! Sign up for market alerts for your zip code at https://movewithmicaela.com/neighborhood-news

Reviews from past clients...

"Micaela's expertise and knowledge helped us clinch an amazing deal...

With the market being as crazy as it is these days, finding a house was no easy feat, that is until we hired Micaela! With houses flying off the market in less than 24 hours, her expertise and knowledge helped us first-time homebuyers clinch an amazing deal on the purchase of our first home. Her willingness to answer any question we had at any time of the day really put us at ease knowing we were in good hands. She made sure we dotted our Is and crossed our Ts when it came down to signing contracts, and to ensure we got everything we were looking for in the sale. We are truly grateful to have had Micaela as our agent, and we HIGHLY recommend hiring her for the sale or purchase of your next home." - Client in Bergen County, NJ

"Why hope to land the sale of your home when you can StanaLAND the sale, Micaela style!?...

The best real estate agent we've ever worked with, Micaela Stanaland is truly a master marketer who sold our home in two days at top-of-the-market price! Selling our family home upon becoming empty nesters was an exciting but difficult emotional endeavor, but I can honestly say that Micaela handled every aspect of this sale with professionalism and grace--and she is now a forever family friend. From her amazingly cool drone photos to the lively social media video teaser set to music to show the best parts of our home, Micaela set up this sale and sold as soon as we hit the market. She then followed thru, proactively and patiently, right up to the closing! - Client in Orange County, NY

"Micaela made sure I understood the entire process and ensured I got the best selling price for the home...

Micaela represented me when I sold my home and I cannot say enough wonderful things about her. From the beginning to the end she was absolutely amazing. She made sure I understood the entire process and ensured I got the best selling price for the home. She was extremely responsive, organized and knowledgeable of the whole selling process. Micaela made sure the process went as smoothly as possible and offered her help in any and every way she could. If you’re looking to buy, rent or sell I HIGHLY recommend using her as your realtor. I cannot thank you enough for getting me through this!!!" - Client in Orange County, NY

Who's Your Realtor?

Micaela Stanaland

Sorry, we couldn't find any posts. Please try a different search.

MICAELA STANALAND | January 5, 2023 | Rockland County

Rockland County: 2022 Real Estate Market Recap

ROCKLAND COUNTY: No stranger to the media, the real estate market has been making national and local headlines on the regular for the past three years.

Current and prospective homeowners alike have been reading just about every good, bad, and in-between article that has been published. With mixed messages on where the market is heading, we're all hoping to gain a little insight into what's really going on with the market.

Is it time to buy? Is it time to sell? Can people even afford where they live anymore?

As a local Rockland County agent, I'm here to dive in to the Rockland Real Estate Market, how last year compared to the past ten years, and what direction it appears to be heading in 2023.

All data courtesy of OneKey MLS

Micaela Stanaland

Rockland Real Estate: 2022 Overview

(Click to jump to each section)

New Listings in 2022

New listings in Rockland County hit a ten-year low in 2022.

This past year, there were only 2,570 new single-family listings to come to the market. This is down 13.03% from 2021, when there were 2,955 new single-family home listings that hit the market.

For the first time in ten years, Rockland County had a month of new listings in the double - not triple - digits. December 2022 saw the fewest number of new listings to come on the market, with just 77 new single-family listings.

What does this mean?

As a seller, there's less competition right now if you're thinking about selling your home. This is generally the case anyways for the winter market in Rockland County, but this year it's a little more...extreme. This could mean you're more likely to get a higher sales price for your home than when inventory is heavy, BUT - don't make the mistake of overpricing your home. Some properties present better than others in the winter season, plus buyers are becoming more cautious when making an offer on a home.

As a buyer, there's less new inventory for you to chose from. Inventory likely won't pick up for at least another few months when we head into our Spring market. Keep in mind, this is also when more buyers start looking for homes. Make sure you're on an auto-search with the criteria for your ideal home and area and keep an eye out for homes that come on in the winter that those Spring buyers will miss!

Fun facts & figures: 2019 had the highest number of new listings in our ten-year period, when 3,351 new single-family listings came to market (23.31% more than 2022).

Our Inventory Prediction for 2023:

We're predicting that new listings will begin to rise as the year goes on. If you're wondering by how much...

Over the past ten-years, we saw a median of 3,158 new listings come on in Rockland each year, with an average of 256 new listings each month. I'd be surprised if we broke the 3,000 mark in 2023 (remember that in 2022 we saw just 2,570 new listings).

In my opinion, I think we'll be higher than 2022's new inventory numbers but probably end up right around 2013's numbers where we saw 2,893 new single-family listings. This doesn't sound like a huge increase, but when you look at the two years side by side, it's like having an extra month of inventory/new listings.

Where will the new listings come from? I think a good chunk of them will come from people who bought in the past 12-30 months. We're finding a lot of buyers experiencing some buyer's remorse, and even more that felt like they rushed into buying a home that doesn't really work for them.

For those that didn't buy in that time frame and are sitting on a little more equity, we're seeing a decent amount of sellers feeling like they "missed the boat" on the hottest seller's market our area has ever seen (check out the absorption rates we discuss later). The market it still up for sellers, but I wouldn't expect the multiple offer in 24-hours situation, especially for the higher end market.

More listings will obviously give buyers more options, although a lot of buyers are pumping the breaks until interest rates (maybe) come down. While interest rates creep up, they are nowhere near historical highs (1980s anyone?). Rather, they're back to what they were in the early 2000s. Of course this isn't ideal for a buyer financing a mortgage, but if you are a buyer keep in mind that if/when rates come down, you can always refinance. Marry the home, date the rate.

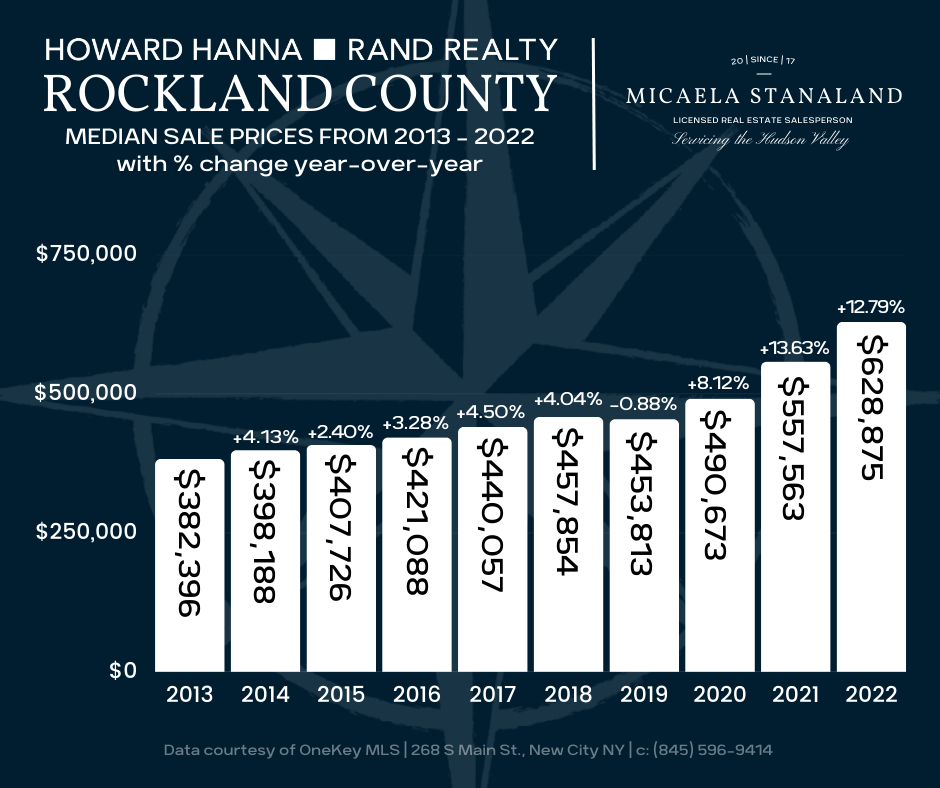

Median Sale Price in 2022

The lower the amount of new listings to hit the market, the less inventory buyers have to chose from. Low inventory in any market will cause prices to remain elevated until inventory can meet demand. Although mortgage rates may be up, people still need a place to live.

The median sale price in Rockland County hit a ten-year high in 2022, reaching an astounding $628,875 - up 12.79% from 2021's median sale price of $557,563.

For the past ten-years, the median sale price in Rockland has been on the rise, with the exception of 2019 where prices took a slight dip (down 0.88% from the year prior). This in part could have been due to the fact that 2019 had the highest amount of new listings in the ten-year period.

From 2013 to 2022, the median sale price has increased at a median rate of 4.13%. While this adequately portrays the market from 2013 to 2018, however 2020 to 2022 was a different story.

Median Sale prices by year in Rockland (with percent change year over year):

What does this mean?

For sellers in Rockand, the numbers from the past three-years look too good to be true. As an agent, I would caution that soon - they will be.

From mid-2020 through the first half of 2022, we had the perfect storm for real estate. Low interest rates combined with low inventory and high buyer demand was every seller's dream. Majority of properties were calling for "Highest and Best" offers within days of hitting the market, and more often than not selling for over asking price.

Just look at the numbers - from 2013 to 2022, the median sale price in Rockland County is up nearly 65% (if you bought in 2013, check out what your home could be worth).

Price Prediction for 2023:

If I had to guess an increase or decrease in the median sale price, I'd say decrease. Not "fall off the cliff" decrease like some headlines are projecting, but more around the mid-to-high $500,000's for Rockland County.

If we go with the median change in home prices over the past ten-years (+4.13%), we'd be looking at a median sale price of $654,845 (emphasis on the 845 ay?). However, I'm predicting that with interest rates higher than what we've been used to for the past two and a half/three-years, it's going to scare some buyers out of the market. This will of course drive demand down - slightly - and with our predicted increase in inventory, balance out the market...somewhat.

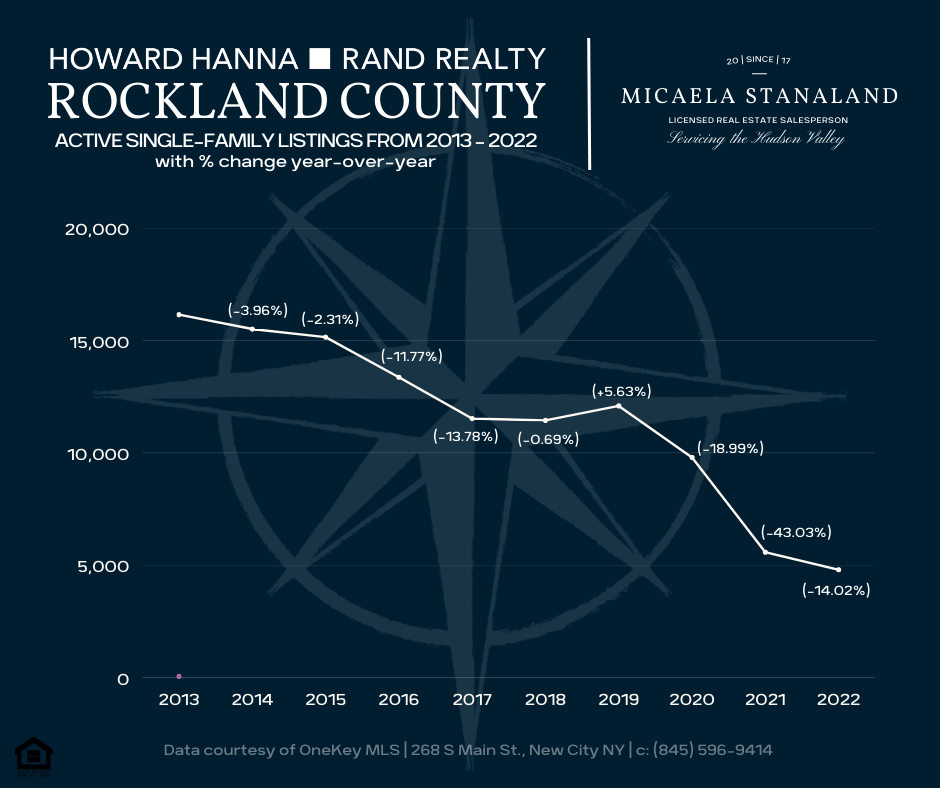

Active Listings in 2022

Active listings in real estate are - as you probably guessed - properties that are currently on the market. These are the homes that are available to buyers.

Since 2013, the number of active listings in Rockland County has been on an overall decline, with the exception of 2019. This decline has a direct correlation with the number of new listings that are coming to market, and also gives us an idea of number of sales that are taking place in Rockland County (think - desirability).

In 2022, we saw the fewest amount of active listings available in over ten-years. Take a look:

Active Listings in Rockland County from 2013 to 2022:

What does this mean?

In the real estate industry, we look at number of active listings as an indicator for two things:

(1) The "competition" our sellers have in a given market

(2) The absorption rate of a given market

An "absorption rate" is a percentage calculated by looking at how fast homes are selling in a specific market within a certain timeframe. The general rule of thumb is anything over 20% is a seller's market and anything below 15% is a buyer's market.

From 2014 to 2016, Rockland County's absorption rate ranged from 9.8% to 15.3% which we'd classify as a buyer's market. If you bought your home during this time, you probably paid under what the seller was asking for. In fact, homes purchased from 2014 to 2016 in Rockland County closed for an average of 94.2% of the original asking price.

From 2017 to 2019, we saw a neutral market for buyers and sellers with the absorption rate ranging from 16.8% to 18.8% in Rockland. This is further reflected in the average close to original list price during those years, where homes were closing at 96.1% of their original asking price.

From 2020 to 2022, we saw one of the strongest seller's markets ever, with the absorption rate ranging from 23.8% to 48.3% during those years. Homes on average closed at 99.6% of their original asking price. This is better reflected in 2021 and 2022 when on average homes closed for 100.2% of their original asking price. This means majority of buyers were paying over what sellers were asking for their homes (likely due to multiple offers and bidding wars).

Our Predictions for 2023:

With sales slowing down and less buyers in the market, tied in with our prediction of inventory increasing this year, we're predicting active listings are going to rise in Rockland.

Why? Sellers are going to take time to adjust to a slower market (read: lower sales prices) which in turn will leave buyers reluctant to make offers on homes that are over-priced. Tie this in with a smaller buyer pool (read: less people looking at and making offers on homes) and that's going to leave even more homes on the market.

2023 will be all about pricing correctly, and strongly. Make sure you hire an agent that knows their local inventory, and be realistic about the upgrades/improvements your property needs that buyers aren't readily overlooking anymore. As an agent that represents both buyers and sellers, I can say majority of buyers are not waiving inspections anymore. Unless you have a home in pristine condition, you can expect buyers to ask for repairs and/or credits for those larger ticket items.

The Recap:

The days of the Wild West market are coming to an end. We don't see it being the "Real Estate Armageddon" that some media companies are forecasting, but rather a slow-down that will lead to a healthier market over time.

Sellers: Don't anticipate a multiple offer situation in 24-hours like we were seeing these last couple years. Have patience with the market and with the buyers (especially during the slower winter months). If you're getting ready to list your home this year, take the time now to make those repairs that buyers are more likely to call out during the inspection process. Not sure what needs to be done? Get in touch with us for a no-obligation analysis of your home.

Buyers: There aren't as many of you out there these days, but that doesn't mean there aren't any of you. A cooling market will work in your favor. For the best "deals", look at homes that have been on the market a little longer and might need a little more TLC (if you're up for it). Buyers are for the most part looking for homes that are move-in-ready and need little to no upgrading, so if you don't mind putting work into a home, the properties that need it are likely going to be the ones with little to no offers on the table.

Inventory is still low. At the time we wrote this article there were only 264 single-family homes available in the MLS in Rockland, which with sales in the past thirty days puts us at an absorption rate of 55.3% (remember that anything under 15% is a buyer's market, anything above 20% is a seller's market).

I personally believe the winter is a great time to look for a home because there aren't as many buyers out there. Start your search here or get in touch with us to see what steps you should be taking to become a stronger buyer.

We work with buyers and sellers throughout Rockland, Orange and Bergen Counties, and help sellers relocate out-of-state. If you have questions about your move or the market in general, we're always happy to talk.

Don't forget to share this page with friends and family in Rockland! Sign up for market alerts for your zip code at https://movewithmicaela.com/neighborhood-news

Reviews from past clients...

"Micaela's expertise and knowledge helped us clinch an amazing deal...

With the market being as crazy as it is these days, finding a house was no easy feat, that is until we hired Micaela! With houses flying off the market in less than 24 hours, her expertise and knowledge helped us first-time homebuyers clinch an amazing deal on the purchase of our first home. Her willingness to answer any question we had at any time of the day really put us at ease knowing we were in good hands. She made sure we dotted our Is and crossed our Ts when it came down to signing contracts, and to ensure we got everything we were looking for in the sale. We are truly grateful to have had Micaela as our agent, and we HIGHLY recommend hiring her for the sale or purchase of your next home." - Client in Bergen County, NJ

"Why hope to land the sale of your home when you can StanaLAND the sale, Micaela style!?...

The best real estate agent we've ever worked with, Micaela Stanaland is truly a master marketer who sold our home in two days at top-of-the-market price! Selling our family home upon becoming empty nesters was an exciting but difficult emotional endeavor, but I can honestly say that Micaela handled every aspect of this sale with professionalism and grace--and she is now a forever family friend. From her amazingly cool drone photos to the lively social media video teaser set to music to show the best parts of our home, Micaela set up this sale and sold as soon as we hit the market. She then followed thru, proactively and patiently, right up to the closing! - Client in Orange County, NY

"Micaela made sure I understood the entire process and ensured I got the best selling price for the home...

Micaela represented me when I sold my home and I cannot say enough wonderful things about her. From the beginning to the end she was absolutely amazing. She made sure I understood the entire process and ensured I got the best selling price for the home. She was extremely responsive, organized and knowledgeable of the whole selling process. Micaela made sure the process went as smoothly as possible and offered her help in any and every way she could. If you’re looking to buy, rent or sell I HIGHLY recommend using her as your realtor. I cannot thank you enough for getting me through this!!!" - Client in Orange County, NY

Who's Your Realtor?

Micaela Stanaland

Hudson Valley October Real Estate Market

OCTOBER 2021 The Hudson Valley Real Estate Market is still going strong for sellers! Another […]

FIRST TIME HOME BUYER CHECKLIST

7 STEPS EVERY FIRST TIME HOMEBUYER SHOULD TAKE

So, You're Ready to be a Homeowner?

Being a first time home buyer can be overwhelming. Check out this 7-step guide on some of the best practices you should be doing before buying your first home.

Micaela Stanaland, Licensed Real Estate Salesperson

Howard Hanna | Rand Realty

February 2, 2022

Step 1: Check Your Credit Score

If you're going to be financing your first home, your credit score can greatly effect the type of loan you qualify for. Generally speaking, the higher your credit score, the lower your interest rate will be. Lower interest rates on your loan directly correlates with a lower monthly mortgage payment (and who wouldn't want that?).

Everyone's credit score ranges from 300-850 points:

- 800 or higher: Exceptional

- 740 to 799: Very Good

- 670 to 739: Good

- 580 to 669: Fair

- 579 or lower: Poor

According to a 2021 VantageScore report, the average credit score in America is 697.

Don't beat yourself up if your credit score isn't where you would like to see it. Your Local Mortgage Lender will be able to review your credit score with you to see what is effecting your score the most. They'll help you strategize ways to pay off any debts that are carrying the most weight on your score.

“A low credit score can make it less likely that you would qualify for the most affordable rates and could even lead to rejection of your mortgage application. It’s still possible to be approved with a low credit score, but you may have to add a co-signer or reduce the overall amount you plan to borrow.” - Bruce McClary, spokesman for the National Foundation for Credit Counseling

Step 2: Set a Monthly Budget

Depending on where in the country (or world!) you choose to live, a mortgage could easily be your largest monthly expense. When it comes to setting a monthly budget for your home, remember to take into consideration:

- Your Current Income

- Outstanding Debts (i.e. student loans, car loans)

- Fixed Monthly Expenses (i.e. gym membership, subscriptions)

- Your Ultimate Financial and Life Goals

28% of your gross monthly income is a good rule of thumb for setting a mortgage budget.

If you're financing your purchase, the lender/bank will ultimately set the max budget for you. However, knowing where you're comfortable financially is a crucial first step in buying a home.

MIKE VANMANSART

Senior Loan Officer at Hudson United Mortgage

c: (845) 239-6565

mike.vanmansart@hudsonunited.com

NMLS #153067

Step 3: Speak With a Lender & Get a Pre-Approval

A mortgage lender is the person/institution that will determine whether or not you qualify for a loan. Lenders have specific guidelines for loan qualifications, and take into consideration a borrower's (that's you!) Gross Income, Debt-to-Income Ratio, and Credit Score.

Your mortgage lender will be the person that writes your pre-approval. What you need for a pre-approval will vary depending on whether or not you're self employed, but will generally include:

- Name & Address of Current Employer(s)

- Prior Two Years W-2 Tax Statements

- Social Security (if applicable)

- Disability Payments (if applicable)

- Pension Income (if applicable)

- List of Recurring Debts (i.e. auto loans, student loans, child support)

- Assets (i.e. bank statements, stocks)

Be sure to ask any lender you speak with (whether it's a bank or a broker!) about special programs they offer for first time home buyers.

Step 4: Hire a Real Estate Agent

Your real estate agent is going to be the one that guides you along your home purchase. They'll set you up on listing alerts, show you properties, negotiate your offer, and get you to the closing table!

It's never a bad idea to interview or talk with a few agents before hiring one. Some things to consider when hiring an agent (other than their personality!) are their communication skills, their locality (do they cover the area(s) you're looking in?), and their overall experience with home buyers. Don't be afraid to Google the agents you interview and take a look at their most recent reviews from past clients.

And an added bonus - in majority of home buying situations, you don't pay your real estate agent - the seller of the home you end up purchasing does! A great way to say "Thank You" to your agent is by leaving a review for them to share with potential future clients or giving their information to anyone you know that's looking to buy or sell.

MICAELA STANALAND

Licensed Real Estate Salesperson

c: (845) 596-9414

micaela.stanaland@randrealty.com

Step 5: Create a List of 3 "Must-Haves"

You probably have an image in your head of what your next home will look like, which is great! But remember that not every home is going to check off every box.

By creating a list of three to four "must-haves" for your new place, you'll be able to focus better on what's really important in your next home and your agent will have a better idea of what you're looking for.

Remember, "must-have" is different than "want to have". If you have kids, is keeping them in the same school district important? If you have pets, do you need a yard? Do you need to be within a certain proximity to work?

Things like paint colors and flooring can be changed. If you're having a hard time narrowing down your must-have list, ask yourself how long you plan on living there. If it's five years or less, you're likely not going to be looking for your "dream home". If it's 10 years or more, focus on the potential of the property and if a house is something you can make into your dream home.

Step 6: Set a Timeframe

When you're starting to look for homes, it's unlikely you'll be buying the first house you see. Not saying "one and done" doesn't happen, but - according to the National Association of Realtors, the average homebuyer spent 8-weeks house hunting and saw an average of 9-homes.

Depending on the size of the neighborhood(s) you're looking in, this number can vary. If your desired neighborhood has only a few homes that come up for sale every so often - or what we call, "low inventory" - then you'll likely be looking longer than that.

Another important factor to keep in mind is who the market is currently favoring - buyers or sellers? If you're searching for a house in a "seller's market", that means the market is favoring the seller, not you, the buyer. A "seller's market" was the market that we saw in the majority of suburban areas through the early 2020's, and most homebuyers spent months and or even over a year looking for a home.

No matter the market, the most important thing to keep in mind during your search is patience. This will (quite literally) be the key to your new home. Set a timeframe and stay focused.

Step 7: Get Out There!

Saving the best for last - with your budget set, your trusted agent by your side, your "must-haves" narrowed down, and your timeframe in place - it's time to get out there and start looking at homes!

Sure, you've probably been scrolling through hundreds on your phone or laptop (looking at homes online will become a pastime even after you move into your new place) but now it's time to actually get out there with your agent and see some homes in person.

An insider tip: Drive by homes that you're interested in before you go to see them. Get a feel for the neighborhood and local amenities if you're looking in an area that you're not familiar with.

Happy House Hunting!

We're here to answer your questions about the home buying process. Always feel free to reach out to us at micaela.stanaland@randrealty.com for your real estate questions.

If you're ready to start your search, create your free account on our website, and download our app for the latest Real Estate in Rockland, Orange, Bergen and Westchester Counties.

P.S. - Don't forget to follow along our real estate (and travel!) adventures on our LinkedIn, Instagram, Facebook, and Pinterest accounts.

Last Updated November 2, 2021

OCTOBER 2021

The Hudson Valley Real Estate Market is still going strong for sellers!

Another month of low inventory and steady (if not increasing) buyer demand resulted in high sale prices in this past October, with each county surpassing sales from the same month last year.

Here's a closer look at how the real estate market turned out last month for Rockland, Orange, Bergen, and Westchester Counties.

Rockland County Real Estate Recap

October 2021 | Micaela Stanaland | c: (845) 596-9414

254

This past October, the OneKey MLS recorded 254 single-family home sales in Rockland County, ranging from $226,000 to $2,580,000.

This is slightly lower than October 2020's recorded sales of 268 sales, which ranged from $163,000 to $3,800,000.

$595K

Rockland County's median sale price for a single-family home last month was $595,000.

This number is up nearly $80,000 from last October, when the median sale price in Rockland was $518,000.

22 Days

The median time a house spent on the market this October before stopping showings (which is typically done after the sellers accept an offer) and/or going into contract.

Homes sold a week faster this past October compared to the same month last year.

Rockland's Current Real Estate Market:

Updated November 2, 2021

Single-Family Homes for Sale: 366

Median Asking Price: $699,000

Price Range: $100,000 to $5,500,000

Orange County Real Estate Recap

October 2021 | Micaela Stanaland | c: (845) 596-9414

396

This past October, the OneKey MLS recorded 396 single-family home sales in Orange County, ranging from $65,000 to $1,226,217.

This is nearly 100 sales lower than October 2020's recorded 482 sales, which ranged from $65,000 to $2,075,000.

$385K

Orange County's median sale price for a single-family home last month was $385,000.

This number is up $60,000 from last October, when the median sale price in Orange County was $325,000.

30 Days

The median time a house spent on the market this October before stopping showings (which is typically done after the sellers accept an offer) and/or going into contract.

Homes sold about a week faster this October compared to the same month last year, which had a median 38 days on market.

Orange County's Current Real Estate Market:

Updated November 2, 2021

Single-Family Homes for Sale: 936

Median Asking Price: $400,000

Price Range: $60,000 to $30,000,000

Bergen County Real Estate Recap

October 2021 | Micaela Stanaland | c: (845) 596-9414

634

This past October, the NJMLS recorded 634 single-family home sales in Bergen County, ranging from $33,000 to $5,300,000.

This is about 30% lower than October 2020's recorded 912 sales, which ranged from $175,000 to $6,996,018.

$610K

Bergen County's median sale price for a single-family home last month was $610,000.

This number is up nearly $30,000 from last October, when the median sale price in Bergen County was $581,000.

37 Days

The average time a house spent on the market this October before stopping showings (which is typically done after the sellers accept an offer) and/or going into contract.

Bergen County's Current Real Estate Market:

Updated November 2, 2021

Single-Family Homes for Sale: 1,194

Average Asking Price: $1,300,000

Price Range: $57,000 to $33,000,000

Westchester County Real Estate Recap

October 2021 | Micaela Stanaland | c: (845) 596-9414

566

This past October, the OneKey MLS recorded 566 single-family home sales in Westchester County, ranging from $150,000 to $11,500,000.

Similar to Bergen, this is about 30% lower than last October's recorded 784 sales.

$715K

Westchester County's median sale price for a single-family home last month was $715,000.

This is the only County of the four that experienced a decrease in the median sale price when compared to lsat October, where the median sale price was $742,000.

27 Days

The average time a house spent on the market this October before stopping showings (which is typically done after the sellers accept an offer) and/or going into contract.

Westchester County's Current Real Estate Market:

Updated November 2, 2021

Single-Family Homes for Sale: 1,240

Median Asking Price: $875,000

Price Range: $120,000 to $100,000,000